Executive Summary:

- AI is revolutionising modern asset management

- AI understands the underlying mechanisms for effective decision-making

- There are numerous AI-driven investment solutions, and each has its best practices for success

- The emerging trends for AI in asset management include generative and analytical AI, Alpha Generation with AI, and enhancing overall operational efficiency

Introduction to AI in Asset Management

Artificial Intelligence (AI) is revolutionising the world of asset management. As financial markets become increasingly complex, Asset and Wealth managers are turning to AI to guide their investment decisions. From analysing market regimes to constructing portfolios, AI is proving to be a powerful tool that enhances the efficiency and effectiveness of investment strategies. In many ways, AI can be considered a game-changer in asset management, just as it has transformed various other industries. By enabling more efficient data processing and enhancing our capacity to comprehend and adapt to the complexities of the real world, AI has found its way into the modern toolset of the financial sector.

Financial markets are experiencing unprecedented complexity and competition, making the identification of valuable insights hidden within data more critical than ever before. AI presents itself as a significant evolution from the traditional quantitative approach to investing. It overcomes the well-known limitations of conventional models, such as their inability to quickly adapt to changing circumstances and comprehend the intricate, time-varying, and complex relationships that underlie financial markets. AI excels at understanding the dynamic nature of financial markets, offering a dual opportunity: improving the quality of investment decision-making and rapidly adapting to the evolving financial landscape.

To appreciate the role of AI in asset management, let's draw a parallel to the pharmaceutical industry's approach to developing new drugs. Finance has increasingly drawn insights from other fields, particularly biology and medicine, where the scientific method plays a crucial role in decision-making.

Consider the development of a new drug: Researchers invest significant effort in understanding the cause-and-effect relationships between a drug's composition and its impact on bacteria. This knowledge allows them to predict how the drug will interact with human cells and why patients might experience improvement after taking it. Rather than rushing into clinical trials, which come later in the process and test for potential side effects, researchers first seek a deep understanding of the drug's underlying mechanisms.

Similarly, applying statistical techniques to study financial market behaviour without comprehending their underlying mechanisms may prove inadequate. Financial markets are characterised by a high degree of complexity and constant evolution. Effectively separating the signal (useful information) from the noise (non-useful information) is essential for modelling and controlling interactions among the variables involved and obtaining valuable insights. Employing the scientific method, with an understanding of financial market dynamics and their economic and behavioural rationale, allows us to anticipate how financial markets will respond to various circumstances and maintain control over their evolution.

In contrast, a traditional quantitative approach to asset management might resemble testing a new drug on a few patients without a deep understanding of its interactions with human cells. AI's approach to asset management can be compared to studying the intricate interactions of drug molecules with human cells before conducting tests.

With a holistic understanding of market dynamics, AI empowers asset and portfolio managers to make informed investment decisions, reducing the risk of unexpected events derailing their strategies. AI-driven models perform the work of thousands of analysts, making it possible to chase the statistical relevance of investable signals hidden within data. By gaining control over market dynamics through AI, asset and portfolio managers can develop strategies that transform collected information into profitable and resilient portfolios, enabling them to navigate market complexity successfully.

With its ability to identify the signals within the noise of data, and provide a comprehensive understanding of market dynamics, AI is the technology that is powering asset managers to gain a competitive advantage in this evolving landscape.

AI is no longer just a buzzword; it's a powerful tool that is shaping modern asset management. In the following sections of this article, we will delve deeper into the specific ways AI is revolutionising asset management and explore the emerging trends that are reshaping the industry.

AI-Driven Investment Solutions: What Are They And Which Are Their Best Practices

AI-driven investment solutions encompass a diverse range of financial instruments, including investment funds, certificates, AI-driven discretionary mandates, and more. At their core, these solutions leverage the power of AI to inform and enhance the decision-making process. AI serves as a crucial collaborator, providing valuable insights that shape investment strategies and portfolio construction. For instance, investment managers maintain control over the definition of the investable universe, investment constraints, and the overall execution of the investment strategy. However, they do so with AI as their trusted partner, influencing and guiding their choices.

This collaborative approach allows asset managers to harness AI's capabilities in a way that aligns their positioning with the ever-evolving dynamics of financial markets. The result is enhanced adaptability, improved risk management, and the ability to navigate high-volatility periods with confidence.

AI empowers asset managers to make real-time adjustments in response to changing market conditions, ensuring that investment strategies remain in sync with market dynamics. During moments of heightened volatility, these solutions enable asset managers to maintain composure and make data-driven investment decisions.

Creating effective AI-driven investment solutions requires a strategic approach. Here are some best practices to consider:

1. Cross-Functional Collaboration

Successful AI-driven investment solutions often stem from a collaboration between asset managers and external providers with expertise in AI. This cross-functional partnership brings together the industry knowledge of asset managers and the vertical expertise of AI providers. Asset managers provide insights into the specific dynamics of their industry, while external collaborators contribute their AI and R&D expertise. This synergy ensures that AI solutions are not only technically robust but also tailored to the unique needs of the asset manager.

2. Ongoing Monitoring

Dedicated professionals should play integral roles in the development and ongoing oversight of AI models and systems. This collaboration ensures transparency into the underlying processes employed by the AI technology. At MDOTM, for instance, a dedicated Mission Control team is established to monitor AI outputs and ensure seamless operations of the technology.

3. Data Quality

The foundation of AI-driven solutions is quality data. Incorporating quality data, such as macroeconomic, fundamental, and market data, is imperative. Such data forms the foundation upon which AI insights are built.

4. Explainable Architecture

The architecture of AI models should be inherently explainable. This means that each component of the model should be traceable and comprehensible, enabling stakeholders to understand the reasoning behind the AI’s reasoning. For instance, MDOTM Sphere's architecture is modularly designed to prioritise traceability and explainability. (You can learn more about it here)

5. AI Explainability

Asset managers should have the ability to interpret both the inputs and outputs of AI models. This empowers them to review investment decisions and make adjustments when faced with changing market environments. Tools like MDOTM Sphere's Chat-GPT Portfolio Commentary provide detailed explanations of AI outputs, enhancing the explainability of the technology’s output.

AI-driven investment solutions have brought in a new era of asset management, where human expertise collaborates with AI insights to make informed decisions. By embracing these best practices, asset managers can harness the full potential of AI, ensuring transparency, data quality, and explainability in their investment strategies. These solutions not only offer a competitive edge but also position asset managers to thrive in an ever-evolving financial landscape.

How AI Tools Are Powering a New Era of Investment Solutions

AI tools are powering a new era for investment solutions, fundamentally transforming the way investment professionals approach decision-making. These cutting-edge tools play an important role in multiple facets of the investment process, offering enhanced capabilities and insights that were previously unattainable. Let's delve into how AI tools are reshaping the landscape of investment solutions:

1. Custom Constraints Made Easy: One of the remarkable ways AI tools are revolutionising investment solutions is by simplifying the incorporation of custom constraints. Investment professionals can now define their specific constraints, and AI takes on the heavy lifting, providing timely inputs tailored to these constraints. This streamlines the decision-making process, allowing investment experts to focus on strategic considerations while AI handles the technical intricacies.

2. What-If Scenarios: AI tools introduce the powerful concept of "What-If Scenarios" to investment professionals. These scenarios enable professionals to simulate and explore various situations, gaining insights into how their portfolios would perform under different conditions. Whether assessing the impact of market volatility, economic shifts, or other variables, AI-driven What-If Scenarios empower professionals to make data-driven decisions and adapt their strategies proactively.

3. Forecasting Market Regime Shifts: AI tools have the capability to forecast the probability of market regime shifts. For example, MDOTM’s Sphere can provide valuable insights into the probability of transitioning into low-risk, high-risk, or mid-risk market scenarios. Investment professionals can use these forecasts to adapt their strategies, adjusting their portfolios in anticipation of changing market dynamics. This forward-looking approach enhances risk management and portfolio optimisation.

4. Streamlined Investment Processes: Perhaps one of the most significant contributions of AI tools to investment solutions is streamlining the overall investment process. These tools facilitate rapid portfolio construction, in a matter of minutes, or the seamless upload of existing portfolios. AI-powered portfolio enhancements based on custom constraints further refine investment strategies. Moreover, AI tools provide timely forward-looking indicators that guide investment decisions. The result is a more efficient, modern, and intelligent approach to managing investments.

AI tools are not just a technological innovation; they represent a paradigm shift in investment decision-making. By simplifying complex tasks, enabling scenario analysis, forecasting market shifts, and streamlining processes, these tools empower investment professionals to make informed, data-driven choices. The fusion of human expertise with AI-driven insights is propelling the financial industry into a new era of investment solutions that are more agile, responsive, and effective.

Emerging Trends in AI for Asset Management

The world of asset management is undergoing a technological revolution, driven by emerging trends in AI. These trends are set to redefine how asset managers operate, make decisions, and provide services to their clients. In this section, we'll explore some of the most significant AI-driven trends that are shaping modern asset management:

1. Generative + Analytical AI: Transforming Asset Management

According to Boston Consulting Group's recent industry insight "How Asset Managers Can Transform with Generative AI", Generative AI has the potential to revolutionise the asset management industry and poses itself as an industry frontier in 2023. In investment management, the relationship between generative and analytical AI emerges as a powerful tool, enhancing the way investment decisions can be made and understood. Analytical AI, with its proficiency in data analysis, serves as the foundation of this partnership. It's the engine that processes vast datasets, examining historical market data, and economic indicators. Analytical AI has the capacity to uncover intricate trends, correlations, and patterns. It provides investment professionals with invaluable data-driven insights, risk assessments, and strategies for optimising investment portfolios.

Generative AI, on the other hand, plays a role in ensuring transparency and explainability in investment decisions. It works with human interaction and operates in response to specific prompts or queries. This aspect of generative AI is particularly significant when applied to investments, as it bridges the gap between the analytical output of AI and the human understanding of the technology’s reasoning.

The synergy between these two forms of AI is most evident with regards to AI explainability. Investment professionals often seek to understand the rationale behind AI-generated investment inputs. While analytical AI can pinpoint trends and suggest portfolio adjustments, generative AI steps in to provide comprehensive explanations. When an investment decision is made based on analytical AI's insights, generative AI can create detailed reports that explain the reasoning behind each recommendation. These reports serve as a critical link between the intricate analyses performed by analytical AI and the decision-makers involved. They break down complex data into understandable narratives, allowing investment professionals and clients to grasp why particular investment insights have been provided.

2. Alpha Generation: The Power of AI

Deloitte Global's recent report "Artificial Intelligence, The next frontier in investment management" underscores the significance of AI in generating alpha. Firms that keep pace with or lead in applying new AI-driven approaches open up opportunities to outperform their peers. The exponential growth of data creation further emphasises the importance of harnessing data as a source of investment insights.

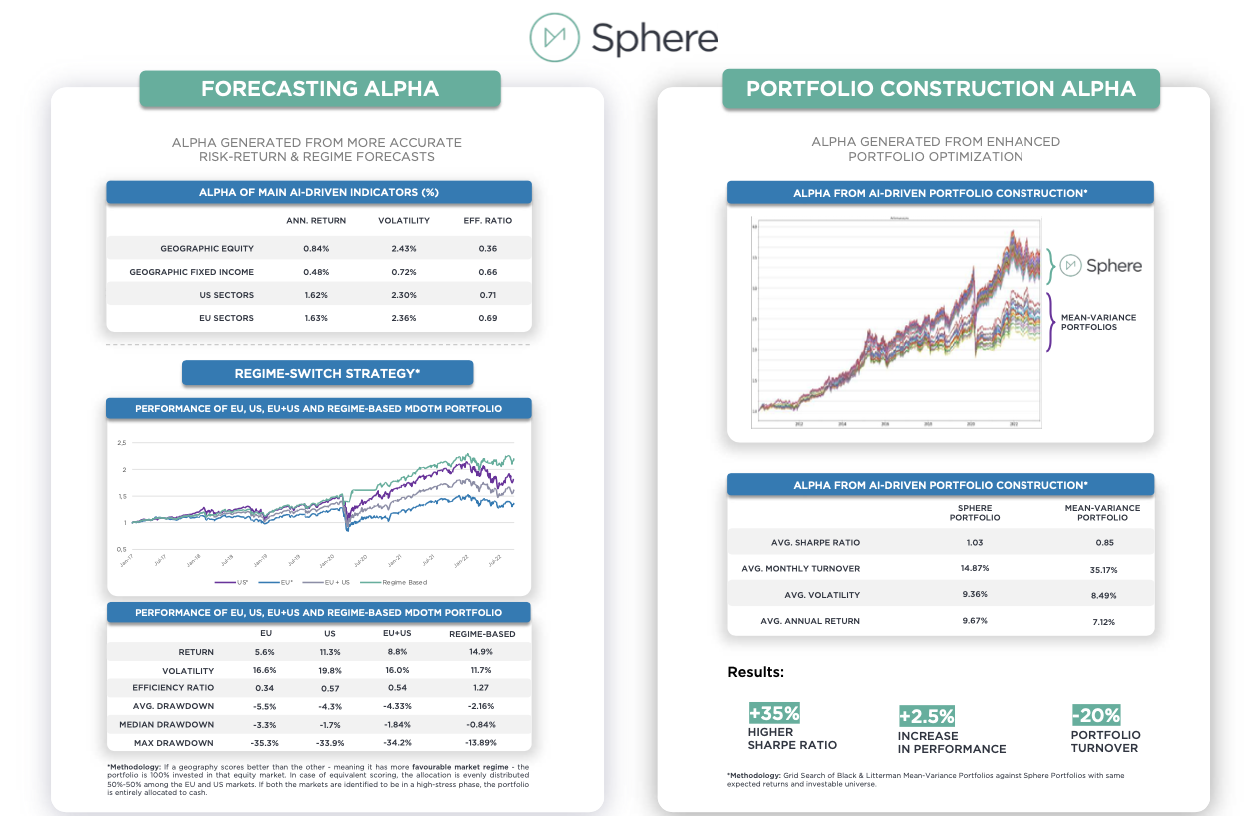

By analysing millions of data points every day, AI can help investors anticipate and forecast future market trends with a higher degree of accuracy (What MDOTM has identified as Forecasting Alpha), while also enabling them to adhere to a well-defined strategy to systematically achieve an optimal portfolio construction (What MDOTM has identified as Portfolio Construction Alpha).

3. Enhancing Operational Efficiency: AI's Impact

Operational efficiency is paramount in today's asset management landscape. Firms are striving to manage costs effectively to offset new regulations, fee pressures, and the shift toward lower-cost passive products. AI is serving as a catalyst for enhancing operational efficiency in several ways:

- Automating Repetitive Tasks: In the world of investments, AI automates data analysis and portfolio management tasks, freeing up investment professionals to concentrate on strategic decision-making and market analysis, ultimately delivering more value to their clients.

- Modular Architecture: AI processes are increasingly built on modular architectures, enhancing agility and enabling seamless integration. This flexibility allows firms to externalise non-core activities as services.

- Risk Management: AI equips firms with advanced tools to bolster risk management functions, automate data analysis, and anticipate and manage uncertain events.

AI is ushering in a new era of asset management, characterised by increased efficiency, enhanced decision-making capabilities, and the potential for greater alpha generation. These emerging trends represent transformative shifts in how asset managers operate and provide services, promising a more agile, responsive, and effective future for the industry.